Education Credits are for Children? Think Again!

Article Highlights:

- Who Qualifies for Education Credits

- American Opportunity Credit

- Lifetime Learning Credit

- Qualifications

- Who Gets the Credit

- 1098-T

- Qualified Expenses

Who Qualifies for Education Credits

If you think that education credits are just for sending your children to college, think again. The credits are available to you, your spouse, and your dependents. Even if you or your spouse only attend school part-time, you still may qualify for a tax credit.

AOTC and LLC

There are two education-related credits available: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). For either credit, the student must be enrolled in an eligible educational institution for at least one academic period (semester, trimester, or quarter) during the year. An eligible educational institution is any accredited public, nonprofit, or proprietary post-secondary institution that can participate in the U.S. Department of Education’s student aid programs.

The credits phase out for higher-income taxpayers who are married filing jointly, or who are unmarried. Those who are married filing separately do not qualify for either credit.

The following table provides the qualifications and details for both credits:

*Generally, credits are non-refundable, meaning that they can only be used to offset your tax liability; any amount exceeding your current-year tax liability is lost. However, unlike other credits, the AOTC is partially refundable in most cases.

Many individuals who work and attend school can be enrolled less than half-time and still qualify for the LLC.

Qualifications

Another interesting twist to education credits is that the taxpayer who qualifies for and claims the student’s exemption for the year gets the credit, even if someone else pays the expenses. Thus, even if a noncustodial parent pays a child’s college expenses, the custodial parent gets the credit if he or she is otherwise qualified. The same applies when grandparents help pay for their grandchild’s education: they do not qualify for the credit unless they, not the child’s parents, claim the student as a dependent.

Generally, the educational institution sends a Form 1098-T to the taxpayer (or dependent). This includes the information necessary to complete the IRS form and claim the credit. Sometimes the 1098-T needs to be retrieved online from the educational institution. The law requires the taxpayer to have this 1098-T in hand to claim either of the credits, but credit can be claimed for other qualified expenses.

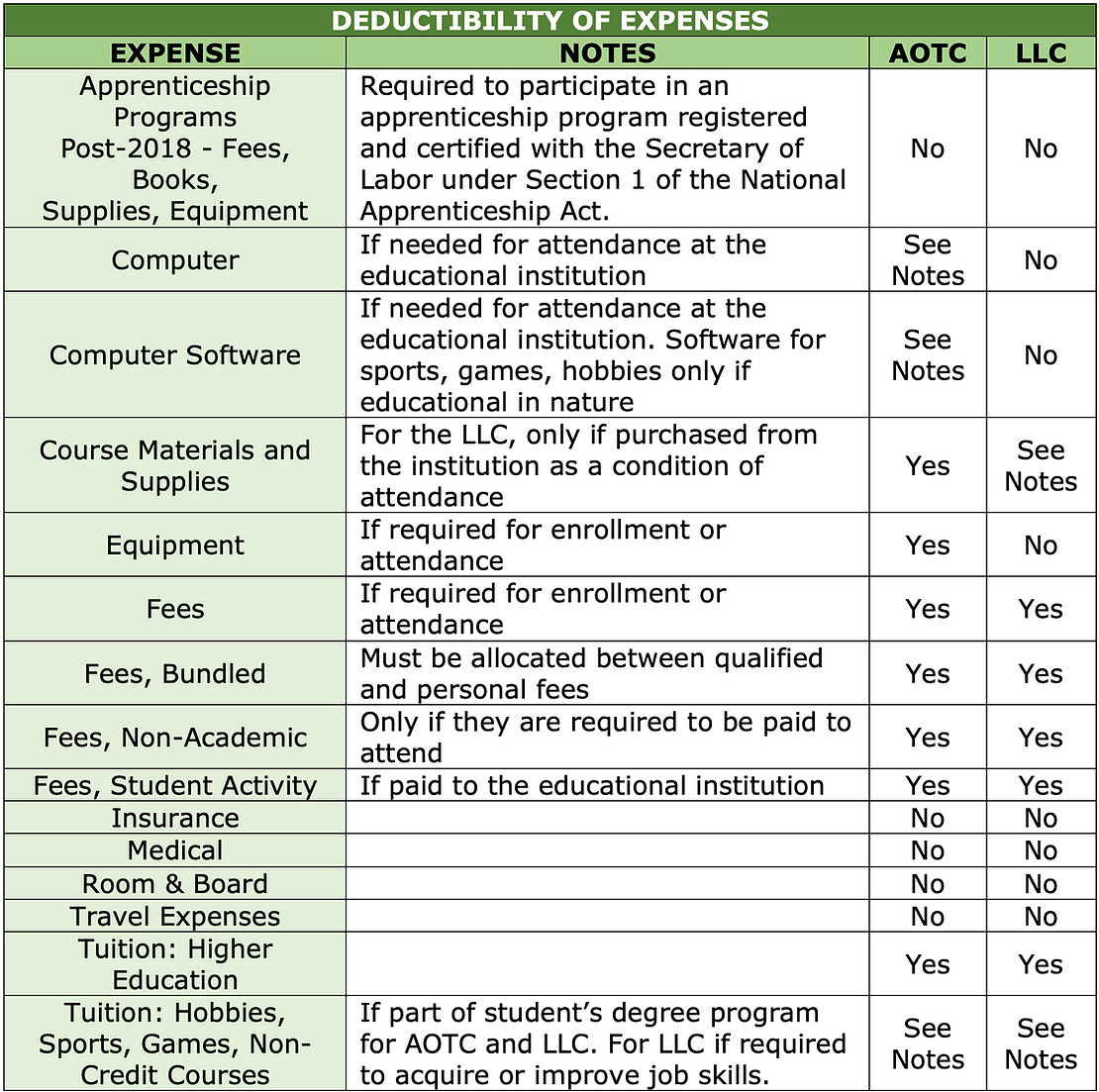

The qualifying expenses for the AOTC and LLC differ in many cases. See the table below for which expenses qualify for the credits.

If you have questions about how these education tax credit provisions apply to you or if you are missing out on credit, please give this office a call.

Leave a Reply